Having a bank account is now a must in many cases. Opening a bank account is quite an easy task. You can own a bank account without any hassle if you have the required documents. You can read this post to know:

- What is a bank?

- Types of banks

- Benefits of the bank

- Types of bank forms

- How many types of bank accounts

- Who can open a bank account?

- What it takes to open a bank account

- Rules for opening a bank account

- Online bank accounts can be opened in those banks

What is a bank?

By bank we mean a company that keeps money. Profits are also available in case of depositing money in the bank. However, the work of the bank is not over just by depositing money.

Banks raise capital by collecting money deposited by an individual’s savings or organization. The bank makes a profit by providing or investing the said capital among the entrepreneurs.

Types of banks

Banks can be categorized in different ways based on multiple activities. We know the bank mainly on the basis of ownership. Types of banks on the basis of ownership:

- Government banks

- Private banks

- NGO Bank

- Autonomous Bank

- Partial bank

- Foreign-owned banks

- Public-Private Joint Ownership Bank

There are also different types of banks based on the structure. E.g.

- Single Banking: Single Bank is a bank that operates through a single office.

- Branch Banking: A bank operating through a number of branches is called a branch bank. We see mainly branch banks in Bangladesh.

- Chain Banking: Chain banking is a banking system run on the basis of support and cooperation of multiple banks considering the benefits.

- Group banking: When some relatively weak banks operate in alliance under a strong bank, it is called group banking.

- Merchant Banking: Merchant banking is a banking system developed through exchange and investment.

- Mixed Banking: Mixed banking is a banking system consisting of deposits from the people and long term investment by the institution.

The bank is also divided into different sections based on the activities of the bank. Hearing these types of names gives an idea about the bank. E.g.

- Central Bank

- Commercial Bank

- Agricultural Bank

- Industrial Bank

- Exchange Bank

- Investment Bank

- Mortgage bank

- Transport Bank

- Small and cottage industries bank

- Import-Export Bank

Again, the bank can be divided into different parts based on the organization of the bank. E.g.

- Sole proprietorship bank

- Partnership Bank

- Co-owned bank

- Specialized banks

- Cooperative Bank

- State Bank

Banks can also be divided into different sections based on the region of the bank’s activities. E.g.

- Regional Bank

- National Bank

- International Bank

There are also different types of banks for managing bank accounts. E.g.

- Workers Bank

- Women’s Bank

- School bank

- Consumer Bank

There are also banks run from a religious point of view. For example, Islamic Bank.

Benefits of the bank

In addition to depositing money, the bank has many other benefits. Some of the notable advantages of the bank are:

- The process of payment through bank account has become much easier. With ATMs and debit-credit cards, it has become much easier for banks to make payments anywhere.

- In case of keeping money in hand, even if there is fear of theft, the money kept in the bank is safe.

- By depositing a significant amount of money in the savings account, it is possible to get profit as well as savings.

- Proper use of bank loans is an easy solution to many personal or institutional financial problems.

Learn more: What and how to get a credit card

How many types of bank accounts

There are four common types of bank accounts we use in our daily lives. Types of bank accounts are:

Current account

Any person or organization can open such a bank account. This type of account is usually used to withdraw money at any time to save money. For such accounts, interest is not usually paid by the bank, but an annual fee is deducted. For this type of account, debit card, guarantee card, check book, even overdraft etc. are available from the bank.

Savings account

The name gives an idea of the activities of this type of account. Savings account is basically used for depositing money. Anyone can open a single or joint savings account.

The majority of Savings Account users are salaried employees, pensioners and students. One of the main features of a savings account is that a certain amount of profit is paid by the bank for depositing money in this account for a certain period of time.

The rate of return paid by the bank can be on daily, weekly or monthly or yearly basis. It is possible to achieve the target by keeping short term money in such accounts keeping in mind the future.

Recurring Deposit Account

Recurring deposit accounts are opened for a certain period of time to save some amount of money and achieve higher interest rates. In this type of account, a certain amount of money has to be deposited every month for a certain period of time, in return for which the total amount including interest is paid after a certain period of time. The term of this type of account is usually six months to ten years.

Fixed Deposit Account

A fixed amount of money is deposited in the bank for a fixed period of time in a fixed deposit account or FD account. The general condition is that the money deposited cannot be withdrawn or withdrawn before the expiration date. (If you take it, you will get less profit or not). The amount of interest payable, the term, etc., vary from bank to bank.

Learn more: BKash account opening rules

Who can open a bank account

You must be at least 18 years old to open a bank account. Apart from individuals, bank accounts can also be opened in the name of a single or jointly owned entity and any legal entity established in accordance with the law.

Type of bank account opening form

A form is required to open a bank account, which is provided by banks. Bank account forms can be divided into two parts based on usage. E.g.

- Personal Account Form: Creating an account for personal use requires a personal account form. This type of form can be used to open a bank account in the name of one or more persons.

- Institutional Account Form: Institutional account forms have to be used to open a bank account in the name of the organization outside the personal account.

Learn more: Easy way to open a cash account

What it takes to open a bank account

Some documents are required to open a bank account. These documents are essential for opening a bank account. Note that Variations may be seen in the case of documents mentioned in Bankveda.

To open a bank account Usually Whatever it takes

- Bank paid account form

- Two recent passport size color photos of the account holder (attested may be required)

- A passport size copy of the nominee taken recently

- Account holder and nominee, photo identity card of both, such as national identity card / passport / driving license, copy of any one

A bank account can also be opened using a birth registration certificate. However, in that case any other credible credentials with a picture of the account manager may have to be provided.

Opening the business current account of a sole proprietorship requires an updated trade license and the seal of the institution. Demand for this specialty has grown significantly as a result of recent corporate scandals.

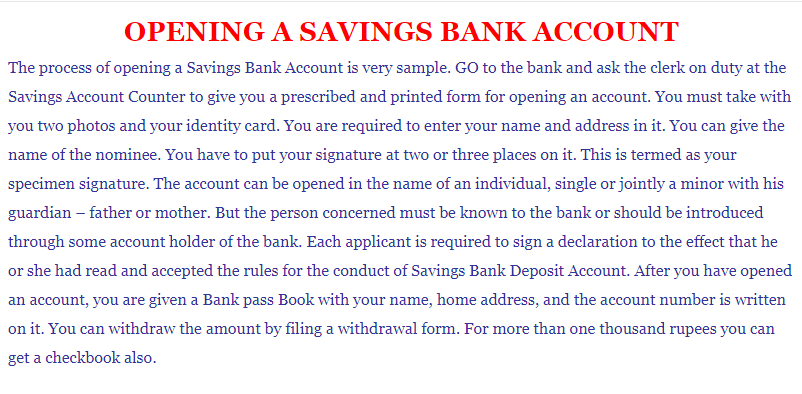

Rules for opening a bank account

When opening a bank account, you should know about the following useful things:

- Form: Collect the account form provided by the bank and fill the form with appropriate information.

- Specimen Signature Card: The account holder has to sign in front of the bank officer, which is known as Specimen Signature Card. In most cases this card is given along with the account opening form.

- Identifier: An identifier is required to confirm the identity of the person opening the bank account. Even if the identifier is not present in person at the time of account opening. However, the obligation to have an identifier is no more.

- Nominee: In the absence of the person opening the account, the owner of the account is called the nominee.

Collect the above mentioned documents and information and contact the nearest branch of the bank you want to open an account with. However, it is best if you can first call the bank’s helpline and talk. This will make it easier to get the necessary documents. If the information and documents provided by you are correct, your bank account will be created in a short time.

Learn more: Ways to open an account

Bank accounts can be opened online in those banks

The process of opening a bank account in person is very simple. The convenience of opening a bank account has been added to make the process of opening a bank account easier. As a result, you can open a bank account at home. Below is a list of some of the banks that can open bank accounts online at home.

- National Bank: National Bank account can be opened from NBLiPower app. To download the app Click here Please.

- Dutch Bangla Bank: Even if you apply for an online account, you have to go to the bank and submit the documents. An online account can be opened from the Nexus Pay app. To download the app Click here Please

- Citibank: Citibank account can be opened online from Ekhoni App. To download the app Click here Please.

- Sonali Bank: Sonali eSheba Account can be opened from the app. However, in the case of internet banking Sonali eWallet The app is to be used.

- UCB: You can open an account using the UClick app as well as online banking. To download the app Click here Please.

- Islami Bank: In addition to opening an account using the CellFin app, funds can also be transferred. To download the app Click here Please.

- IFIC Bank: This link Bank account can be opened at home using.

- Bank Asia: At this link You can go and apply for savings or current account. However, even if you apply online, you have to go to the bank and submit the documents.

Apart from the mentioned banks, some other bank accounts can be opened online at home. You can also learn about the rules for opening a bank account online by visiting the bank’s website.

If you have any questions regarding bank account, please let us know in the comments section. We will do our best to answer your question as quickly as possible.

[★★] Want to write about technology? Now one Technician Open an account and post about science and technology! fulcrumy.com Create a new account by visiting. Become a great technician!