Read more: Corona Second Wave relied on sunlight! Why do experts say that?

Another major advantage of this scheme is that customers can open this policy jointly with the members of the house. Any Indian citizen from the age of 30 to 65 can avail the benefits of this scheme.

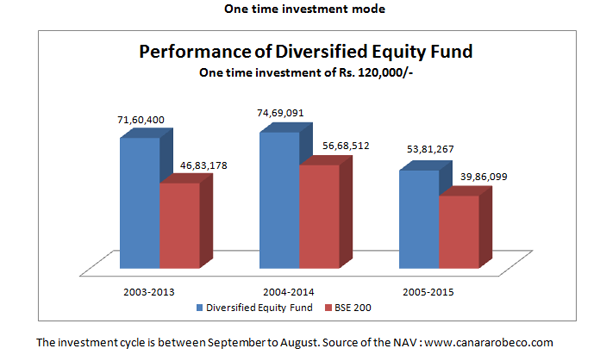

According to the scheme, any person who has reached the age of 45, if he invests a lump sum of Rs 10 lakh, will get a pension of Rs 74,300 per annum. Customers will be able to avail the benefits of this pension immediately after the investment or even after 15 to 20 years. However, in that case, the customers have to abide by some conditions. This policy also has the facility of paying premium every year. Note that this policy can be purchased either online or offline. Not only this, surrender can be done three months after taking the policy without any medical document.