The journey of Trust Axiata Pay (TAP for short) has started in Bangladesh. Let’s find out what is Tap Key, Tap Account Key, Tap Account Benefits and Tap Account Opening Rules.

What’s a tap? – What is TAP

Tap is a new mobile banking service developed by a joint venture of Trust Bank and Axiata Group. Taps like other mobile banking like bKash, cash can be used from phone.

After registration, the user’s phone number can be used as a wallet number. Mobile dial menu and app, both can be used TAP or tap.

Benefits of Tap Account

The benefits of Tap Account are similar to other mobile banking apps. The features of Tap Account are:

- Money transfer

- Cash out

- Mobile recharge

- Ed Money

- NID fee

- Utility bill payment

- Tuition fee payment

- Insurance bill payment

- Passport fee payment

- Merchant payment

Learn more: BKash account opening rules (with bonus)

Download Trust Axiata Pay Tap App

Trust Axiata Pay or Tap App can be used on both Android and iOS platforms. Click here to download the Android app for Android powered phones Click. Tap here to download iOS app for iPhone Click.

How to open a TAP account – How to open a TAP account

Opening a tap account is much easier. To open a TAP account only National Identity Card ie NID card He will need a SIM. The rules for opening a TAP account are –

- First install the TAP app from the Play Store or App Store

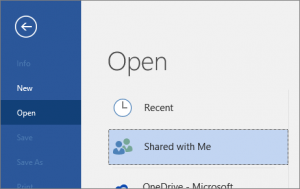

- After installing, open the app

- Press Get Started

- Enter your phone number and select SIM operator

- Then provide the OTP code from the message in the mentioned phone number

- Scroll down and press Agree

- Then select your name, gender and occupation and press Confirm

- Then enter the 4 digit PIN of your Tap Wallet and press Proceed

- Let’s press Continue

- Then take a picture of the front of your NID card and press Confirm

- Then take a picture of the other part of the NID card and press Confirm

- Then all the given information will be displayed

- If all the information is correct, press Confirm

- You will then be asked to take your own selfie

- When the selfie is taken, press Confirm

- The information you provide will then be verified for a few seconds

- If you provide all the information correctly, you will see the login page

- Login to the login page with your tap account number and pin code

Learn more: Rules for opening a cash account

TAP Cash In Charge – TAP Cash In Charge

Cash in from the agent can be done for free in the general TAP account. In case of salary or corporate cash in, 0.90 percent cash in charge will be accepted. In case of student account, the cash in charge of TAP is 0.60 percent. However, you can cash in from Tap’s branch without any charge.

TAP Cash Out Charge – TAP Cash Out Charge

If you tap out cash from the agent using the mobile menu, 1.80 percent charge will be applicable. Cash out charge using the app is 1.50 percent. If you cash out from the branch of TAP, the tap cash out charge is only 1 percent.

Learn more: Ways to open an account (50 taka bonus!)

TAP Mobile Banking Menu Code – TAP USSD Menu Code

Like every mobile banking service, there is a tap and mobile banking menu. Tap Mobile Banking Menu Code is * 201 # which means Tap Mobile Banking Menu Code * 201 # which can be dialed to enjoy all the benefits of Tap Mobile Banking.

Tap Mobile Banking Helpline

If you have any problems using the tab, you can email [email protected] Address. Also tap On the website The following phone numbers are given as helpline numbers:

- T&T Number +88 02 48812261

- Fax number +88 02 48812262

- Helpline number 09612201201

Have you opened or will open a tap account? Let us know in the comments section.

[★★] Want to write about technology? Now one Technician Open an account and post about science and technology! fulcrumy.com Create a new account by visiting. Become a great technician!