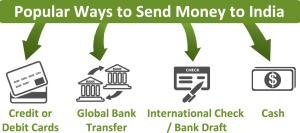

BKash has teamed up with Citibank to launch the country’s first digital loan disbursement service under a new feature. After a year of experimentation, the service officially started on 15th December 2021 Has done. In the beginning, a maximum of 10 thousand rupees digital loan could be obtained under this. Now the maximum amount of bKash loan will be 20 thousand rupees.

This unsecured loan from private bank Citibank will be available instantly in bKash account. Let us know, the answers to some important questions about the development and distribution of this digital loan of Citibank.

How much money can a development loan be?

At present, loans ranging from a minimum of Tk 500 to a maximum of Tk 20,000 will be provided under this bKash digital loan facility. However, this figure may increase further in the future.

What is the percentage interest to be paid on development loan?

This will be available at 9 percent interest rate in accordance with the rules given by Bangladesh Bank Development Digital loan

What are the conditions for taking bKash digital loan?

The most convenient thing about this digital loan service of Citibank and bKash is that the suitable bKash customer can avail this loan anytime anywhere from bKash app. Customers eligible for development will be able to take this loan up to Tk 20,000 without any security. However, only selected bKash customers will get this loan. Not everyone can get a loan right now.

How do I get a bKash digital loan?

This digital loan service is currently being officially launched. That means all bKash users will see loan options in their bKash app. But not everyone gets a loan. The development and city bank authorities will determine the loan amount after checking.

Customers will see the loan or loan icon in their development app. In order to take a loan, the customer has to agree to give the information given to bKash in his e-KYC form to Citibank. Then with the loan amount and your PIN you will immediately get the digital loan money in the bKash account. The interest and other provisions applicable with this loan will be complied with as per the instructions of Bangladesh Bank.

Who will get development loan?

As mentioned earlier, only selected bKash customers can avail this loan from Rs.500 to Rs.20,000. Whether you get a development loan will depend on your credit assessment. Your data will be developed and analyzed by Citibank through modern technology. If they think you are eligible to get this loan, you can take a loan from this loan option in your bKash app.

Alibaba Group’s affiliate “Ant Financial” will provide credit assessment to bKash customers in this project. It will use artificial intelligence technology, said bKash.

What are the development loan repayment rules?

In the next three months after taking the loan, the same amount will be automatically repaid in three installments from the customer’s bKash account on the due date. Before the payment date, the customer will receive notification regarding this via SMS and app.

Whether the borrowers are repaying the loan on time will also be monitored. This will also be considered in the next loan disbursement.

Learn more: BKash app offer – way to get bonus up to 150 taka

If the customer wants, he can repay this loan of Bikash and Citibank before the due date, which can reduce the interest cost. If the customer does not have the required balance in the development account on the due date of installment payment or if the customer does not repay the loan before the due date, the delay fee will be applicable. This delay charge is 2% (annually) on the loan amount.

Why is Citibank and bKash providing this loan?

Citibank Managing Director and CEO Masroor Arefin spoke about the project Says“We always try to be as close to the needs of the customer as possible. Many in our country, especially small traders, suddenly need money. The journey of this digital loan is keeping in mind how to make it more accessible to them and so that they can use that money with ease. We hope that our pilot project will bring better service to our customers by improving the experience gained in this pilot project. ”

3 Information you need to know about bKash and Citibank loans

Commenting on the initiative, bKash CEO Kamal Qadir said, “Commercial banks can launch creative new services using effective digital financial platforms and huge customer base like bKash to play a stronger role in improving the quality of life and financial inclusion of people from all walks of life including marginalized. Citibank’s digital loan scheme is an example of this. We believe that this unsecured loan in case of emergency will be a blessing for marginalized people, young people, marginal traders. ”